Achieving Tax Revenue Targets

… for Fiscal Year 2022-23

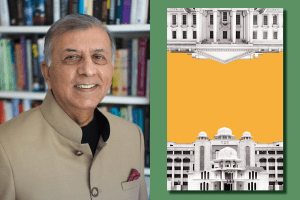

Bilal Hassan

Tax revenue is a major component of federal tax receipts for the government to balance its budgets. For the ongoing fiscal year 2022-23, the government has assigned the Federal Board of Revenue (FBR) a gigantic tax collection target of Rs7.47 trillion. To achieve the assigned tax revenue target, a 21.5% growth in tax collection is required over the total tax collection of Rs6.148 trillion of the last fiscal year 2021-22.

In the first eight months of the ongoing fiscal year, the FBR has collected Rs4,493 billion against Rs3,820 billion collected in the corresponding period of last year. The year-over-year growth of tax revenue collection in the first eight months is 18% against the targeted growth of 21.5% for achieving the assigned tax revenue target of Rs7.47 trillion.

Though the FBR has shown impressive performance during the third quarter of the current financial year; however, for July to January, the tax revenue shortfall is Rs214 billion as tax collection stood at Rs3.965 trillion against the assigned collection target of Rs4.179 trillion. Tax-wise seven-month tax collection from income tax, sales tax, federal excise duty and customs duty is Rs1.747 trillion, Rs1.476 trillion, Rs190 billion and Rs551 billion, respectively.

Despite an impressive performance in revenue collection so far, the FBR would be having a tough time in achieving the full assigned tax collection target of Rs.7.47 trillion due to distressed economic conditions and multiple challenges ahead. This article is structured to discuss those economic and political challenges.

Import contraction

The contraction in imports allowed the current account deficit to decline significantly to $3.8 billion for July to January as against a deficit of $11.6 billion during the same period last year. The imports decreased by 20.9% to $33.4 billion. The trend in import contraction is continued and it has a significant reducing impact on overall tax collection because the importation of goods is subject to an 18% sales tax. Secondly, income tax is collected at 1%, 2%, 3.5% and 5.5% at the import stage on importation of goods and raw materials. Thus, import contraction has a significant declining impact on sales tax and income tax collection at the import stage. The FBR has to increase domestic sales tax and income tax collection through tax policy and enforcement measures. Tax policy measures have already been implemented through mini-budget to collect additional tax revenue. The FBR’s field formations are making efforts to bridge the tax gaps through enforcement as well. Needless to mention that the FBR calculated the tax gap at Rs1,289 billion, 26% of potential collectible tax revenue. The tax gap percent of potential collectible tax revenue calculated under different taxes is as below:

- the income tax gap is Rs730 billion, which is 31% of potential collectible income tax;

- the sales tax gap is Rs519 billion, which is 24% of potential collectible sales tax; and

- the customs duty gap is Rs11 billion, which is 11% of the potential collectible customs duty.

Above tax gaps could be larger as the tax authorities excluded the underground economy and the agriculture sector from the tax gap calculations.

Less-than-expected economic growth

Initially, the 5% target for the growth of gross domestic product (GDP) was fixed by the government for 2022-23 but later on, revised it downward at 2.3% largely due to devastation caused by massive floods across the country. Tax revenue collection has a direct correlation with GDP growth. Consumption expenditure is an important component of GDP. High consumption expenditure means higher GDP growth, keeping other factors the same. Increased consumption expenditure results in high revenue because sales tax is a function of consumption (public and private) expenditure. Similarly, expenditure is also used as a proxy base for collecting income tax through several withholding taxes. Imports and exports also affect GDP growth. Fewer imports and more exports increase GDP. Almost half of sales tax revenue is collected from imports besides trade taxes (customs duty). Similarly, income tax is also collected from imports as well as from exports. Therefore, the slowdown of the economy would have reduced the impact on revenue and meeting the revenue target for the fiscal year 2022-23 would be challenging for the FBR.

Devastation caused by massive floods

Floods during the early months of the ongoing tax year 2023 have played havoc in almost all provinces, particularly in Balochistan and Sindh. Floods destroyed crops and caused the deaths of animals in millions. Furthermore, millions of families became homeless owing to the deduction of homes due to massive floods. Overall economic activity reduced significantly in flood-affected parts of the country, which means less withholding income tax collection on reduced commercial transactions. Moreover, as floods had reduced household income in many parts of the country, there would be a reducing impact on overall consumption expenditure, which means less sales tax collection. For example, major floods affected areas in Sindh fall under RTO Hyderabad and Sukkur and both RTOs reported growth in revenue from July-2022 to 15 Nov-2022 less than the national revenue growth of around 34%.

Tax litigation

The FBR introduced certain new policy measures through Finance Act, 2022, to generate additional revenue of more than Rs233 billion:

- Rs200 billion to be collected through a super tax on high-earning persons under section 4C of the Income Tax Ordinance, 2001;

- Rs18 billion to be collected through capital value tax on foreign assets of resident taxpayers under section 8 of the Finance Act, 2022; and

- Rs15 billion to be collected by taxing deemed income on immovable properties of resident taxpayers u/s 7E.

However, the taxpayers challenged the above new policy measures before different appellate fora. The High Courts stayed the recovery of tax under new tax policy measures. After a lapse of half of the ongoing fiscal year, the Supreme Court directed the taxpayers to pay 50% of the tax liability under these provisions of the Income Tax Ordinance, 2001.

Owing to the above major factors among others, the FBR is facing a shortfall in tax collection. For example, tax collection of Rs663 billion for March 2023 was short by 8.8% from the assigned target of Rs727 billion. The first nine months’ shortfall in revenue collection has reached Rs278 billion as total collection stood at Rs5.155 trillion in the first nine months of FY2022-23 against the target of Rs5.433 trillion. The shortfall in the revenue collection target for March has been observed despite the fact that the government has introduced a number of tax policy measures to raise additional tax revenue. For example, the sales tax rate increased from 17% to 18% and the excise duty on cigarettes also increased significantly.

To achieve the tax revenue target for 2022-23, the field formations of the FBR have to take measures to recover tax revenue from tax evaders and avoiders. Needless to mention that the taxable persons can evade due taxes under prevailing political and economic uncertainty.

The writer studied Taxation Policy & Management at Keio University, Japan, and is serving as Additional Commissioner (Inland Revenue) Corporate Tax Office, Lahore.