The Middle East and China’s Belt and Road Initiative

China’s presence in the Middle East is on the rise, particularly in the framework of its Belt and Road Initiative. As the US draws down its commitments in the region, China has scaled up its engagement, developing relations with a myriad of countries, including those on different sides of regional divides. It has become a major import-export partner for countries such as Israel, Saudi Arabia, Qatar and Iran. Central to China’s growing presence in the region is Beijing’s Belt and Road Initiative (BRI), which seeks to create greater connectivity between Asia, Africa and Europe as a means of boosting China’s economic growth.

Although the Belt and Road Initiative (BRI) is touted as having potentially huge developmental implications for the Middle East, the clearest beneficiaries so far appear to be regional countries that are important to China’s energy and shipping security. Above all, these are the wealthy Gulf States and Israel. The restricted focus of the BRI notwithstanding, China’s increased economic engagement with the region will inevitably lead to growing involvement in regional security affairs.

BRI in the Middle East

The BRI primarily seeks to open up new markets and secure global supply chains to help generate sustained Chinese economic growth and, thereby, contribute to social stability at home. It has both a land-based and a maritime component. The former, i.e. Silk Road Economic Belt (SREB), seeks to connect China to Europe, largely via Central Asia, but also to a lesser extent via the Middle East while the latter, i.e. the Maritime Silk Road Initiative (MSRI), connects China to Europe and Africa via the Middle East. The MSRI is conceived as running from the South China Sea via the Indian Ocean, through the Gulf of Aden and the Suez Canal, terminating in Port Piraeus in Greece.

Why Chin is scrambling?

There are several reasons why the Middle East forms a core part of the MSRI.

- Energy imports

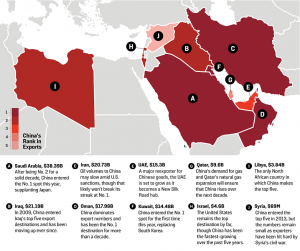

To fuel its economy, China needs huge energy imports; hence, increased dependence on the Middle East. A recent study has revealed that almost half of China’s crude oil and 10-20 percent of its natural gas imports originate from the Middle East, making energy security paramount for Beijing.

- Navigation security

Most vessels transporting goods, including oil, between China and Europe must pass through several choke points in the region. Up to one-third of crude oil shipped over sea has to transit through the Strait of Hormuz, off the coast of Iran and the United Arab Emirates (UAE). Seaborne goods between China and Europe must also pass through the Bab el-Mandeb Strait, off Djibouti and Yemen. This makes China’s energy imports, as well as its goods, vulnerable to disruptions caused by piracy, regional tensions and conflict. Therefore, Beijing has an interest in the security of shipping, as well as in finding alternative routes to avoid maritime chokepoints.

Engaging countries

With the above-mentioned objectives in mind, China has been engaging regional countries through memoranda of understanding (MoUs) and partnerships of varying intensity. The major focus of intensified relations with countries in the region has – not surprisingly – been energy cooperation and the building of infrastructure, including the building of seaports and transportation infrastructure deemed critical to improving navigation security, as well as creating alternative transport routes to bypass chokepoints.

Growing trade relations

Beijing has also sought to deepen trade relations with the region. In addition, people-to-people exchanges form a smaller part of the BRI.

Projects supported within the MSRI framework are facilitated by a number of new financial instruments, including a USD 100 billion Silk Road Fund and the Asian Infrastructure Investment Bank (AIIB), as well as by state-owned Chinese banks. China has also carried out a number of currency swaps with regional countries to help facilitate increased trade.

Priority countries

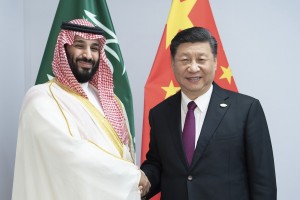

Priority countries of the MSRI are Saudi Arabia, the UAE, Iran, and Egypt. Beijing has concluded comprehensive strategic partnerships with each of these countries, indicating a desire to widen the strategic partnerships by including a wider range of spheres.

- Saudi Arabia

Saudi Arabia supplies the majority of China’s crude oil imports, making it a state warranting particular attention.

- UAE

The UAE is situated on the Strait of Hormuz, through which the majority of China’s oil imports transit. It is, therefore, potentially important for ensuring the smooth passage of vessels transporting oil to China. Its position, as well as its modern infrastructure, also makes it an interesting gateway for goods destined for Middle Eastern markets.

- Iran

China has sought to engage Iran with the aim of diversifying energy suppliers and reducing energy dependence on Saudi Arabia. Stepping up cooperation with Tehran has also been viewed as important for minimizing the risk of disruptions to maritime transport through the Strait of Hormuz. In addition, Beijing is hoping that Iranian oil could one day go over land to China, thereby reducing dependence on seaborne shipping and the risks this entails.

- Egypt

The importance of the Suez Canal for shipping Chinese goods to Europe makes Egypt another key state. Although Egypt’s strategic location makes it central to the MSRI, China is, nevertheless, looking for alternative ways to access the Mediterranean, through Israel, for example, making Israel a less critical but still important country for the MSRI.

Regional Impact

Beijing has framed the BRI as a “win-win” initiative that not only serves China, but also benefits its regional partners. Many countries in the region are interested in the BRI, because of their need for high-quality infrastructure and, in some cases, reconstruction, not to mention the necessary financing for related projects. With burgeoning youth populations, Chinese investments and the possibility of boosting trade with China are also viewed as a source of job-creation. The MSRI is, however, not only of interest to the less wealthy countries of the region, but also to the resource-rich ones that hope an increased cooperation with China will boost their oil exports, particularly following the reduction in US demand. Chinese investment is also seen as a way, over the longer term, of diversifying their economies and dovetails with the development plans of many of the Gulf States that include a reduction of the dependency on oil.

Pouring in of investments

Despite hopes across the region, the economic gains from the MSRI are likely to be unevenly distributed. The major beneficiaries so far are the wealthy Gulf States, particularly Saudi Arabia and the UAE.

- Saudi Arabia

Saudi Arabia is today China’s most important trading partner in the Middle East and China is the kingdom’s biggest trade partner, with the export of Saudi oil and petrochemicals and imports of Chinese machinery and consumer goods forming the bulk of this trade. The kingdom is also a favoured regional destination for Chinese investment, which, to date, remains largely focused on the energy sector. Chinese companies are generally investing in petrochemical facilities, as well as constructing and maintaining nuclear power plants and research reactors, which serves Saudi Arabia’s drive to find alternative sources of power in the light of growing domestic energy consumption and declining hydrocarbon reserves. The hope is that additional investments, like the joint venture to create an industrial park in Jazan Economic City, will contribute to the diversification of the Saudi economy, along with infrastructure to improve the environment for business and tourism

- UAE

After Saudi Arabia, the UAE has become China’s second largest trading partner, trade being comprised mostly of Emirati oil and natural gas exports and imports of Chinese textiles, light industrial products, and machinery. It is China’s second preferred investment location. The UAE’s strategic location and high-end infrastructure make it appealing as a hub for Chinese exports. Emiratis have successfully capitalised on this in a way that suits their own developmental goals. Earlier this year, the UAE and China signed agreements to the value of some USD 3.4 billion to boost Dubai’s role as a regional logistics hub for Chinese goods, which will include the development of Port Jebel Ali. Abu Dhabi’s Port Khalifa is also set to benefit from expansion under the MSRI.

- Egypt

As anticipated, Egypt has also witnessed increased Chinese investment. China is playing a key role in facilitating some of Egypt’s flagship projects launched under President Abdel Fattah El-Sisi. The construction of a new administrative capital is partly financed through a USD 3 billion loan by the Industrial and Commercial Bank of China, for instance. In addition, China is investing in the redevelopment of the Suez Canal and Port Said, as well as industrial zones in the country.

- Israel

In an attempt to create a route from the Red Sea to the Mediterranean that avoids the Suez Canal, Beijing has stepped up the development of transport infrastructure in Israel also. China is, therefore, building a high-speed railway from Eilat on the Gulf of Aqaba to Ashdod Port on the Mediterranean, as well as investing in the expansion of the port.

Construction of a new Haifa Port north of Tel Aviv is also planned. The hope is that goods could be shipped from these ports to the Port Piraeus in Greece that is operated by the China Ocean Shipping Company.

Conclusion

Potentially “win-win” outcomes would seem to apply only to the already wealthy countries of the region, particularly Saudi Arabia, the UAE, and Israel. Countries that are in a more precarious economic situation, such as Egypt, may not reap the expected benefits, and poorer countries that are less critical for energy and navigation security will likely see even fewer benefits. Although China’s interest in contributing to stability within the region, if only to protect its interests, should translate into expanding the benefits of the MSRI beyond the wealthy few and contribute to regional development and stability, unstable investment climates, especially in post-conflict environments (e.g. Syria and Libya at a future point) could limit the extent to which China will be eager to get to involved. The big gains of the MSRI may, therefore, be reserved for only a select few.

China and Regional Security

The Maritime Silk Road Initiative not only has implications for the Middle East region, but also for other external actors with interests in the Middle East, including Europe. So far, China has concentrated on geo-economics, preferring to leave security matters primarily to the United States. However, increased economic and energy interests in the region, as well as growing numbers of Chinese nationals living and working there, could inevitably draw China more deeply into regional security affairs. This, as well as the expected drawdown of US commitments in regional security, is already leading to a realization in Beijing that it may need to engage in more security-related activities in the Middle East, however reluctant it may be to do so.

In fact, this would build upon China’s already growing security footprint in the region. China has been doing more in the area of peace promotion and mediation over recent years. As part of its efforts to step up peacekeeping commitments, China has been contributing to a UN peacekeeping mission in Lebanon since 2006. Beijing has also been involved in mediating some of the region’s most high-profile conflicts, including the Syrian and the Israeli-Palestinian conflicts.

In addition, Beijing has established its first military base outside Chinese territory in Djibouti on Bab el-Mandeb Strait in return for assistance in the development of Djibouti’s military capabilities. The base is intended as a replenishment centre for the Chinese People’s Liberation Army Navy, which maintains a continual naval presence in the Gulf of Aden to carry out anti-piracy and emergency operations in the Middle East and Africa that have already included the evacuation of Chinese nationals from Libya in 2011 and Yemen in 2015.

China is also increasing military cooperation with Iran as a means ensuring navigation security in the Strait of Hormuz. The past few years have seen China conduct joint military exercises with Iran, during which Chinese warships entered the Persian Gulf. Beijing is also believed to be considering using the port of Gwadar in Pakistan, which is it helping to develop, in order to enable a military presence near the Strait.

Jahangir's World Times First Comprehensive Magazine for students/teachers of competitive exams and general readers as well.

Jahangir's World Times First Comprehensive Magazine for students/teachers of competitive exams and general readers as well.