The Ballooning Circular debt

Transmission and distribution parts of the supply chain of Pakistan’s power sector are exclusively owned, managed and operated by the public sector whereas the production sector enjoys contributions from both public and private companies. At the generation level, WAPDA, KESC, Independent Power Producers (IPPs) and Pakistan Atomic Energy Commission are generating electricity from an installed generation capacity of 35,975 MW (Pakistan Economic Survey 2019-20). Ministry of Water and Power was unbundled in 2017 and thermal power management was handed over to Pakistan Electric Power Company (PEPCO). Now PEPCO is managing public-owned generation companies (GENCOs), nine Distribution Companies (DISCO’S), and National Transmission and Dispatch Company (NTDC).

There are 40 gas-, RNLG-, coal- and hydro-based IPPs haring the installed capacity of 17551 MW, and they are generating a substantial amount of electricity in Pakistan (Private Power and Infrastructure Board, Government of Pakistan). Central Power Purchasing Authority (CPPA) that had taken over the market operations of NTDC is now responsible for power procurement and import on behalf of the DISCOs. The other components of the power sector—transmission and distribution—are managed and operated by NTDC and DISCOs, respectively. NTDC owns and operate all 200 KV and 500 KV transmission lines and grid stations. DISCOs (LESCO, PESCO, IESCO, and others) are also federally-owned entities responsible for distributing power to end consumers—domestic, commercial, industrial and agricultural users.

Now we come to the question of circular debt.

Circular debt, also known as power sector payable, is the cascade of unpaid bills, non-payment of subsidies, and low recoveries where receivables of one component of the power sector become payable for others. The problem starts at the level of DISCOs where corruption, mismanagement, power theft and low recoveries result in the accumulation of payables at the level of end consumers. DISCOs, in return, fail to clear their payables to CPPA (or NTDC), and eventually this vicious cycle of unpaid bills cripples the ability of the government to clear the longstanding dues of IPPs, public-owned GENCOs and WAPDA. Resultantly, the power-generation sector remains unable to pay for the fuel to their suppliers, and they either reduce generation of power or shut down their plant(s) completely. Hence, despite having surplus installed generation capacity, power outages and load shedding has become a routine which is a cause of serious disruptions to industrial and commercial activities, thereby hurting the national economy dearly. The gravity of the situation can be gauged from the fact that in the fiscal year 2019-20 alone, the circular debt grew at an average rate of PKR1.5 billion and reached 2.15 trillion at the end of the fiscal year. The payables of the power sector ballooned to a whopping 2.25 trillion by mid-September. A major chunk of power payables belongs to IPPs (830 billion) and other long-standing dues are owed to WAPDA (220 billion), Oil and Gas companies (163 billion), and NTDC (20 billion). This spiralling circular debt is unsustainable, and demands immediate attention to addressing the underlying root causes of the continual accumulation of the payables. The following paragraphs will be dealing with the causes of this crippling situation.

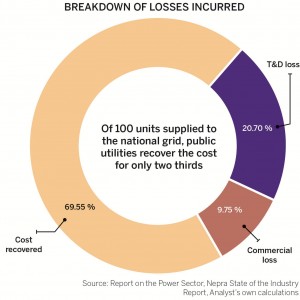

Power theft, inadequate recoveries and transmission and dispatch losses due to corruption, mismanagement and inefficiency on the part of almost all federally-owned distribution companies are some of the biggest contributors to the swelling circular debt in the power sector. Only QESCO and PESCO contribute almost 60 percent to the national circular debt. In the previous fiscal year, power theft and transmission losses stood 29 percent of total power generation which resulted in an addition of PKR140 billion in the power sector payables. Power theft requires effective law-enforcement and deterrence. Here again, the coordination is missing between federally-owned DISCOs and law-enforcement agencies (LEAs) that fall within the provincial jurisdiction, thereby creating coordination-linked difficulties in curbing widespread power theft. In 2015, the non-technical line losses—electricity theft, metre tempering and unpaid bills—caused a loss of $18 billion to the national economy. Almost one-fifth of the electricity generated is lost through poor infrastructure and faulty metering. In 2017-19, Pakistan suffered a loss to the tune of PKR53 billion because of corruption and power theft. Technical line losses due to poor conductors, weak and dilapidated grid, transmission and distribution infrastructure, low time-to-time maintenance and resistive losses (losses due to resistance, atmospheric condition, and heat) have reached 20 percent—certainly an awful squandering of precious power resources. It has been estimated that if these technical and non-technical losses remain unaddressed and unchecked, Pakistan’s total circular debt may rise to PKR4 trillion by 2025.

Distortions at both supply and demand sides are reasons that are compounding the problem of circular debt. On the supply side, we have seen the continuous addition of power plants without consideration to the growth of demand. Under the 2015 Power Policy, which was designed to ensure smooth execution and operation of power projects under CPEC, seven power plants having aggregated power-generation capacity of 8253 MW have already been commissioned. Besides, there are also soon-to-be commissioned plants with an accumulated power capacity of 10,000 MW. If we suppose that Pakistan’s GDP growth remains 4.5 percent (a bullish demand scenario) for the next 5 years, Pakistan will have 3500 MW surplus power supply by the end of 2025, and if we predict the demand-supply situation based on IMF- or World Bank-forecasted GDP growth, Pakistan will continue to have surplus power supply by 2028. In other words, Pakistan will continue to have an excessive supply for the next 5 to 7 years.

On the supply side, too, the situation is worrisome. The major sectors that consume electricity are domestic (46.2 percent), industries (27.7 percent), and agriculture (11.8 percent). Both domestic and agriculture sectors cannot be expected to show a continuous rise in demand; it is the only industrial sector that must show some capacity enhancement to consume surplus power. But owing to expensive and unreliable power, de-industrialization and growing tendencies on the part of major industrial units to have power generation units of their own (captive power supply), the power demand has dumped or stagnated. Increasing supply and decreasing demand have increased the burden on the government to pay for the idle capacity of the IPPs, which is called capacity payment. Capacity payment-linked liabilities of the government have reached to the tune of PKR1 trillion and this is what cripples the power sector of Pakistan.

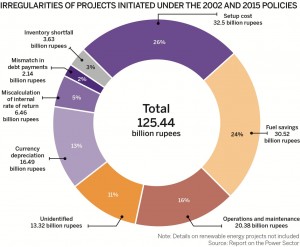

Back in 1990s when it was facing financial constraints amidst a growing demand for electricity, the central government decided to bring in private investment in the generation sector of the supply chain. Resultantly, the government offered generous terms of power-purchase agreement that included payment to IPPs based on their installed capacity instead of power acquisition and consumption, and payment on the return on equity in dollars rather than in Pak rupees. These agreements, backed by sovereign guarantees, were signed under the Power Policies of 1994, 2002 and 2015. Bound by these purchase regimes, the current government is finding it increasingly harder to clear the mounting debt of capacity payment charges. The situation has further worsened due to 30 percent depreciation in Pak rupee value during the last two years, adding PKR186 billion in capacity payment-related charges. The worsening situation can be measured from the fact that the government paid PKR900 billion in FY 2019-20 under head of capacity payment as opposed to 650 billion in the previous financial year, recording a mind-boggling increase of 60 percent on year-on-year basis. The challenge of capacity is also compounding due to alleged exaggerated investment, overstated equity, over-invoiced machinery and unpaid taxes on the part of IPPs. The ever-mounting government liabilities have kept power prices on the higher side despite a notable drop in the fuel cost which has created a serious hurdle in reducing the cost of doing business in Pakistan. Unless the status quo is broken, it is estimated that capacity charges will be hovering around PKR1.5 trillion in the next two years which, in return, will further deteriorate the crisis of circular debt.

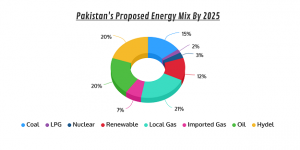

The high cost of production is another factor responsible for the ballooning circular debt. The most important root cause of the higher cost of electricity is the dependency on imported fuel. Pakistan’s power generation mix is largely dominated by imported fuel-based power plants that account for almost 46 percent of total installed capacity. The dependency on imported fuel has created vulnerabilities for Pakistan’s power sector. Fluctuation in the prices of fossil fuel in the international market and instability in the exchange rate of Pakistan have resulted in the worsening of circular debt issue as both state-owned and independent power producers become unable to timely pay for their long-standing dues to fuel-supplying companies, thereby adding further to the circular debt. To stabilize the volatility generated by international and domestic shocks, NEPRA has allowed the government to levy Fuel Price Adjustment on end consumers, thereby significantly increasing the price of electricity in Pakistan. Stagnant demand, inefficiency on the part of DISCOs and GENCOs, power pilferage and wastage have also contributed to the increased liabilities for the government which it seeks to discharge through tariff rationalization and the imposition of various duties and special charges like Neelum-Jhelum and Financing Cost surcharges, etc. This tariff rationalization pushes prices upward and makes the recovery of the bills from consumers difficult for the DISCOs, further adding to the mounting circular debt.

Inconsistencies between market and government-determined power tariffs are also a factor contributing to the piling up of the circular debt. Besides, the government announces subsidies to concessional regimes of the domestic users (the consumption of up to 300 units), agricultural tube-wells, and support for small and medium enterprises. The non-payment of these power subsidies results in the building up of circular debt. It is worth mentioning here that withdrawal of these subsidies is a major demand of IMF for the resumption of its Extended Fund Facility worth $6 billion. The incumbent government is planning to review the power-sector subsidies regime.

Now, we turn to another aspect of the issue, that is, suggesting political, economic and administrative remedial measures for sustainable resolution of the circular debt issue.

Improving the management and operation of DISCOs must be the first and foremost pillar of any strategy carved out to curb the circular debt. In this regard, transferring the ownership to provinces should be contemplated seriously as it will help make the anti-pilferage campaign effective and well-targeted. The management of these DISCOs should be in the hands of the corporate sector as the privatization of these entities would risk political instability and an exorbitant increase in electricity prices. This public-private partnership would go a long way in improving the efficiency of DISCOs, thereby resolving the issues of non-recovery of the bills, and corruption and mismanagement. Overhauling the dilapidated transmission and distribution infrastructure, synchronization of the frequencies and speed of power plants and transmission and dispatch (T&D) networks, improving the conductivity of the conductors (wires) and institutionalized mechanism for the maintenance of the system can pave the way for minimizing the T&D losses to the acceptable level.

Mounting liabilities attributable to capacity charges can be resolved by tackling the issues of debt payment and return on equity. PTI-led government has undertaken a right step in the right direction by renegotiating the terms of agreements with IPPs signed under Power Policies of 1994 and 2002. As per the details shared by the government, it has succeeded in convincing some IPPs (13 in number) to receive their capacity payment in rupees (albeit at the fixed exchange rate of 148 rupees to dollar indexation) and adhere to a take-and-pay mechanism where the government would pay as per the power acquired and consumed rather the installed capacity of IPPs. The scope of this negotiation should be enlarged to cover IPPs under the 2015 Power Policy. The decrease in the spread (interest rate) and relaxation in tenure in the maturity of debt would help decrease the capacity charges to a considerable extent. Evolving an effective auditing mechanism to ensure third-party evaluation of the accounts of IPPs would help resolve the complaints of over-invoicing and exaggerated claims of investment.

Pakistan’s energy mix is unsustainable, both environmentally and financially, as it is dominated by imported fossil fuel-based power generation. This should be rectified as soon as possible. It is indeed a welcome development that PM Imran Khan has announced while addressing Climate Ambition Summit 2020 that Pakistan has decided not to have thermal power plants anymore. He revealed that Pakistan had already scrapped two thermal power plants having accumulated capacity of 2600 MW. He further added that 60 percent of Pakistan’s energy would be clean and green by 2030. Shift to renewable sources of energy or “coal to liquid” or “coal to gas” based power generation would go a long way in ensuring indigenization of power generation and reducing reliance on the expensive imported fossil fuels. The sooner Pakistan shifts to green power generation, the better it will be for our economy and environment, as well as the society.

Circular debt has become a serious stumbling block in the way of sustained growth and development of Pakistan, a hurdle in the unfreezing the IMF program, a bottleneck in the aim of reducing the cost of doing business, and a conduit to squander precious natural resources. Previous governments failed to bring about structural reforms to heal this wound. One can hope that the incumbent government that came to power with heavy reform agenda would come up with a well-delineated strategy to dress this long-festering wound so as to save precious resources for utilization in productive sectors to end the vicious cycle of boom and bust.

The writer is a graduate of the

University of Agriculture, Faisalabad.

He writes on national and international affairs.

Jahangir's World Times First Comprehensive Magazine for students/teachers of competitive exams and general readers as well.

Jahangir's World Times First Comprehensive Magazine for students/teachers of competitive exams and general readers as well.