Raast

Digital Payment System

A Critical Piece in the Financial Inclusion Jigsaw

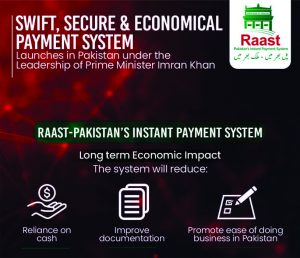

As a part of his Digital Pakistan Vision to include the poor segments of society in formal economy, Prime Minister Imran Khan launched, on January 11, the country’s first instant payment system – Raast. Developed by the State Bank of Pakistan (SBP), in collaboration with Bill and Melinda Gates Foundation and Karandaaz, Pakistan, this system enables end-to-end digital payments among individuals, businesses, and government entities instantaneously. It will provide digital, easy-to-use, efficient and cost-effective payment options to the users. The faster payment system will be used not only to settle small-value retail payments in real time but also provide cheap and universal access to all players in the financial industry, including banks and fin-techs. Raast will not only document the economy, but will also help generate more taxes to help build the country.

In recent years, digital technologies have changed the way people perform their day to day activities and tasks. From shopping to commuting, socializing to making payments, technology has created a world where now things get done on the click of a button. Even once considered bizarre way of doing business, websites and smartphone apps now dominate our daily activities and transactions. Fortunately, the same technologies have also been transforming the payments and banking systems. The payments are faster and transaction takes place almost instantaneously. The world is moving away from the legacy time lapse of two to three business days for clearing a check to a global standard of faster payments with near real time provision of the funds for payees on a 24/7 basis.

Background

Digital finance has the potential to provide access to finance for all in a faster, safer and more affordable manner. However, digital finance can only be utilized to its true potential if a set of public goods is put in place including interoperable payments platforms, digital IDs, affordable smartphones, cybersecurity and an enabling regulatory environment for fintechs and innovative digital products and services based on consumer needs. In its efforts to enhance financial inclusion and improve transparency and efficiency of the financial sector, one of the central goals of the Government of Pakistan was to establish an instant payment system. It was in this backdrop that Prime Minister Imran Khan has launched Raast that Pakistan’s first instant payment system that will enable end-to-end digital payments among individuals, businesses and government entities instantaneously. The state-of-the-art Pakistan’s Faster Payment System will be used to settle small-value retail payments in real time while at the same time provide a cheap and universal access to all players in the financial industry including banks and fintechs.

Digital finance has the potential to provide access to finance for all in a faster, safer and more affordable manner. However, digital finance can only be utilized to its true potential if a set of public goods is put in place including interoperable payments platforms, digital IDs, affordable smartphones, cybersecurity and an enabling regulatory environment for fintechs and innovative digital products and services based on consumer needs. In its efforts to enhance financial inclusion and improve transparency and efficiency of the financial sector, one of the central goals of the Government of Pakistan was to establish an instant payment system. It was in this backdrop that Prime Minister Imran Khan has launched Raast that Pakistan’s first instant payment system that will enable end-to-end digital payments among individuals, businesses and government entities instantaneously. The state-of-the-art Pakistan’s Faster Payment System will be used to settle small-value retail payments in real time while at the same time provide a cheap and universal access to all players in the financial industry including banks and fintechs.

Introduction

Pakistan marked the beginning of 2021 with a digital leap forward following the launch of Raast that will address payment systems infrastructure related issues. Raast will enable frictionless digital payments for citizens of Pakistan as a payment from a sender to a receiver will be made in an easy, convenient, and secure way at a very low price. This will also enable bulk payments from government-to-people, transfer of in-country remittances from people-to-people, and payments from people-to-government possible in real time. It will catalyze a culture of using digital payments for micro payments, estimated to be even less than PKR 1,000 per transaction, instead of cash. This facility will help in shifting consumer behavior from using cash to digital as the preferred way of transactions, reducing the burden of cash management at the micro and macro level.

Pakistan marked the beginning of 2021 with a digital leap forward following the launch of Raast that will address payment systems infrastructure related issues. Raast will enable frictionless digital payments for citizens of Pakistan as a payment from a sender to a receiver will be made in an easy, convenient, and secure way at a very low price. This will also enable bulk payments from government-to-people, transfer of in-country remittances from people-to-people, and payments from people-to-government possible in real time. It will catalyze a culture of using digital payments for micro payments, estimated to be even less than PKR 1,000 per transaction, instead of cash. This facility will help in shifting consumer behavior from using cash to digital as the preferred way of transactions, reducing the burden of cash management at the micro and macro level.

Importance

In Pakistan, more than 50% of the adult population, mostly women, lack access to formal financial services. Most households resort to risky, inefficient, and expensive informal channels to fulfill their financial needs. Immediate clearance of transactions through Raast will keep the system-cost low and providers would contribute data to a shared service, ensuring all users and transactions are legitimate and risk free. With a high mobile phone penetration, Pakistan is well positioned to expand and accelerate digital financial systems and this micropayment gateway will go a long way in spurring financial inclusion in the country and will be giant leap towards our shared objective of every Pakistani being financially included and economically empowered.

Features

According to the State Bank of Pakistan (SBP), the moving force behind Raast, the new digital system will be rolled out in three phases culminating in early 2022. Raast would allow merchants, businesses, individuals, fin-techs and government entities in Pakistan to send and receive near real-time payments through the internet, mobile phones and agents.Developed through a multiyear collaboration between the State Bank of Pakistan and the Bill & Melinda Gates Foundation, with support from the World Bank, the United Kingdom and the United Nations and Karandaaz Foundation, Raast also has a goal of boosting the involvement of women in the formal economy.

According to the State Bank of Pakistan (SBP), the moving force behind Raast, the new digital system will be rolled out in three phases culminating in early 2022. Raast would allow merchants, businesses, individuals, fin-techs and government entities in Pakistan to send and receive near real-time payments through the internet, mobile phones and agents.Developed through a multiyear collaboration between the State Bank of Pakistan and the Bill & Melinda Gates Foundation, with support from the World Bank, the United Kingdom and the United Nations and Karandaaz Foundation, Raast also has a goal of boosting the involvement of women in the formal economy.

Following are some of its significant features:

Instantaneous payments: It provides the end-user a near real-time digital payment experience across individuals, merchants, businesses, and government entities

Interoperable: It allows payments from and to any channel. Raast will allow all financial institutions to seamlessly connect to each other via a single link to the central infrastructure, making digital payments accessible across any channel to customers of any financial institution.

Low cost: It operates on a cost-recovery mindset to provide low transaction cost to participants. It is designed to operate at a cost-recovery model in order to make digital payments affordable to end users of all socio-economic backgrounds.

Simple: It improves adoption and convenience through a Universal payment ID (example mobile numbers, CNIC for an alias may be used in lieu of complex account numbers).

Secure: Raast will introduce more secure payment types, ensure that each transaction is authorized by the payer, and offer enhanced data protection and fraud detection services. It provides ample verification options to ensure the funds are safe and the system is also well protected and ensures secure data protection and authentication throughout the ecosystem

Highly accessible: It allows simpler and broader on-boarding for payment entities such as banks, payment system operator and payment service providers, merchants, government entities via APIs and ensure system processes transactions 24/7 in real-time

Innovative: It allows participants to design new payment and financial services/products. Raast will be built on cutting-edge technological standards, allowing financial institutions to develop innovative and user-friendly digital payment products and services (e.g. payment through phone number/email).

It is pertinent to mention that the Raast Instant Payment System is an advanced retail payment system developed based on international standards such as ISO 20022 and other digital financial inclusion principles like the Level one Principles. It will become the core component of Pakistan’s payment infrastructure and will allow every individual to send and receive the payments instantly in a safe, secure manner.

Expected Roll-out

The Raast Instant Payment System will be rolled out in a phase manner. In the first phase, the system is ready to enable instant transfer of bulk payments such as dividend payments of CDC directly into the bank accounts of investors. Subsequently, the second phase will follow, in which Raast Instant Payment System will enable onboarding of government entities to digitize payments and receipts such as salary, pensions, and payments to Ehsaas and BISP beneficiaries.

The Raast Instant Payment System will be rolled out in a phase manner. In the first phase, the system is ready to enable instant transfer of bulk payments such as dividend payments of CDC directly into the bank accounts of investors. Subsequently, the second phase will follow, in which Raast Instant Payment System will enable onboarding of government entities to digitize payments and receipts such as salary, pensions, and payments to Ehsaas and BISP beneficiaries.

In parallel, SBP will digitize all person-to-person payments (P2P) using mobile phone numbers in place of account numbers by July 2021. This will be followed by the third and final phase of Raast roll out plan by early next year when merchants and small businesses will be enabled to receive instant payments from their customers through different payment modes such as Request to Pay (RTP) and QR payments functionality.

Towards Digital Economy?

Pakistan currently faces a myriad of financial problems, which hamper its growth as well as place impediments in the fruition of development goals. Primary among them is the weak or low tax base.

According to figures provided by the Prime Minister, only two million people in a country of 220 million paid taxes, which was not enough for the desired social uplift of society involving the construction of hospitals, schools and providing other basic facilities of life for the common man. Imran Khan states that only 3,000 of the taxpayers pay 70pc of the tax. It is notable that his government has taken steps to automate collection of taxes on transactions and also tightened rules on banking but is still falling short of targets. Thus, shifting away from a cash-based economy may be a logical step to broadening the tax base as well as tackling corruption.

Currently, remittances from abroad constitute using informal systems like hawala and hundi, which besides being illegal, manage to keep the transaction off the books and encourage money laundering. The instant payment system would not only document the economy, but also generate more taxes to help build the country. Pakistan’s ability to curb illegal financial transactions, including the alleged financing of militant and extremist groups, has been under close scrutiny from international financial watchdog the Financial Action Task Force (FATF). Hopefully, the revolutionary digital system will help Pakistan avoid the hangman’s noose of being blacklisted by FATF.

Analysis

According to the World Bank, in 2017, only 18 per cent of Pakistanis had an account with a financial institution. Access to financial services — storing money securely, accessing competitive loans to smooth consumption or purchase assets, availing insurance to weather financial shocks, sending money to relatives with minimal fees, making and receiving payments quickly and affordably — is increasingly recognised as a basic need in a modern economy. For the poor, financial inclusion can build resilience, provide a safety net, and make daily financial transactions more convenient. For a daily wager, for example, sacrificing a day to visit a BISP centre or to pay utility bills may mean a significant loss in wages. The majority of Pakistanis lack access to payments services that would allow them to conduct such transactions efficiently and at a low cost. This is where many hope Raast will make a difference.

Raast will be a game-changer for Pakistan. The system, part of the government’s broader Digital Pakistan initiative, has an admirable — if lofty — goal of shifting the economy from cash to digital. Raast aims to enable secure, efficient and transparent financial transactions which, the PM insists, will help fully utilise the country’s potential and transform the economy. The belief is that Raast will facilitate and encourage millions of poor people to step into the formal economy.

Unfortunately, it remains to be seen what will be done to encourage willing widespread adoption among people outside the formal economy. We also feel the belief that Raast will help widen the tax base may be misaligned with the previous goal. Most people who function entirely outside the formal economy would pay little, if any, income tax since they are already poor. The fact that government salaries, pensions, and welfare payments will all reportedly use Raast means that some people will be pushed to become early adopters. However, we must remind that the two former categories already pay their taxes, while the latter is, as discussed, too poor to be taxed.

A better short-term alternative would have been to push companies and businesses to shift to full digitisation of records, which would help create better records of where money is going. This includes salaries paid in cash, which we believe is what the PM was referring to. That is not to say that the system won’t work. The success of existing private sector payments systems such as JazzCash and EasyPaisa make this quite clear. As technology becomes more accessible, it becomes easier for consumers, rich or poor, to manage their finances from the comfort of their homes. Internationally, it is becoming relatively common for young people to be fully integrated in the formal company without ever having set foot in a bank. This is something that Raast and others, including traditional banks, could help facilitate.

While it would take longer for the benefits to the government through such an approach to become visible, we believe it would be a more pragmatic one.

Jahangir's World Times First Comprehensive Magazine for students/teachers of competitive exams and general readers as well.

Jahangir's World Times First Comprehensive Magazine for students/teachers of competitive exams and general readers as well.