Federal Budget 2020-21

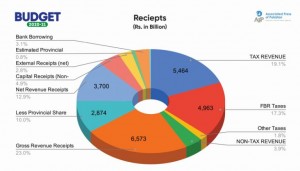

On June 12, Federal Minister for Industries and Production, Hammad Azhar, presented in National Assembly the federal budget for the financial year 2020-21, having a total outlay of Rs7.137 trillion as against Rs3.70 trillion worth of net federal revenue, leaving a deficit of Rs3.43 trillion which comes to something around 7% of the GDP. That the net federal revenue is not even enough to cater to two major liabilities of the federal government – defence Rs1.28 trillion and debt servicing Rs2.94 trillion, equalling Rs4.22 trillion – speaks of the hollowness of the government coffers. The total revenue, however, is estimated at Rs6.57 trillion, including Rs4.96 trillion tax revenue and Rs1.61 trillion non-tax revenue. It’s the Rs2.87 trillion worth of provincial transfers under the NFC Award that reduces the federal revenue to Rs3.70 trillion.

The federal government presented, on June 12, largely tax-free budget for fiscal year 2020-21 with a total outlay of Rs 7.137 trillion , reflecting a reduction in its size by 11 percent from the budget estimates for fiscal 2019-20. The resource availability for 2020-21 is estimated at Rs 6314.9 billion as against Rs 4917.2 billion in budget estimates for 2019-20 with net revenue receipts estimated at Rs 3699.5 billion, reflecting an increase of 6.7 percent over budget estimates for the current year. The provincial share in federal taxes is however lower by 11.7 percent than the budget estimates for the current year. Net capital receipts are projected to increase by a hefty 75.93 percent Rs 1463.2 billion as against Rs 831.7 billion for the current year. The external receipts for 2020-21 are estimated at Rs 2222.9 billion, reflecting a decrease of 26.7 percent over the budget estimates for the current year.

Salient features

The budget 2020-21 has the following salient features:

–Total outlay of budget 2020-21 is Rs 7,294.9 billion. This size is 11 percent lower than the size of budget estimates 2019-20.

–The resource availability during 2020-21 has been estimated at Rs 6,314.9 billion against Rs 4,917.2 billion in the budget estimates of 2019-20.

–The net revenue receipts for 2020-21 have been estimated at Rs 3,699.5 billion indicating an increase of 6.7 percent over the budget estimates of 2019-20.

–The provincial share in federal taxes is estimated at Rs 2,873.7 billion during 2020-21, which is 11.7 percent lower than the budget estimates for 2019-20.

–The net capital receipts for 2020-21 have been estimated at Rs 1,463.2 billion against the budget estimates of Rs 831.7 billion in 2019-20 reflecting an increase of 75.93 percent.

–The external receipts in 2020-21 are estimated at Rs 2,222.9 billion. This shows a decrease of 26.7 percent over the budget estimates for 2019-20.

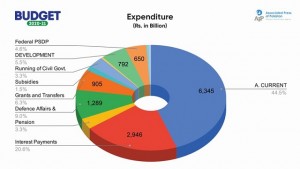

–The overall expenditure during 2020-21 has been estimated at Rs 7,294.9 billion, out of which the current expenditure is Rs 6,345 billion.

–The development expenditure outside PSDP has been estimated at Rs 70 billion in the budget 2020-21.

–The size of Public Sector Development Programme (PSDP) for 2020-21 is Rs 1,324 billion. Out of this, Rs 676 billion has been allocated to provinces.

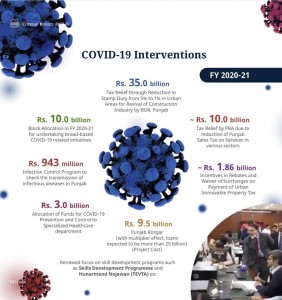

–Federal PSDP has been estimated at Rs 650 billion, out of which Rs 418.7 billion for Federal Ministries/Divisions, Rs 100.4 billion for Corporations, Rs 3 billion for Earthquake Reconstruction and Rehabilitation Authority (ERRA), Rs 7 billion for COVID responsive and other natural calamities programme.

–Total Federal Board of Revenue taxes for the year 2020-21 are estimated at Rs 4,963 billion.

— Non-tax revenues for the upcoming year are estimated at Rs 1,108.9 billion.

— Gross revenue receipts are estimated at Rs 6,573.22 billion out of which provincial share is Rs 2,873 billion.

–The net revenue receipts for federal government in budget 2020-21 are estimated at Rs 3,699 billion, showing an increase of 6.8 percent over the budget estimates of 2019-20 and 19.24 percent over revised estimates of outgoing fiscal year 2019-20.

- External resources

–The government obtained loans and grants to bridge the gap between the receipts and expenditure. The net external resources for 2020-21 after deduction of foreign loans repayment (Rs 1,228 billion) and repayment of short term credits (Rs 183 billion) have been projected at Rs 810.34 billion are lower by 73 percent and 64.34 percent respectively when compared with budget and revised estimates 2019-20.

- Current Expenditures

–Total current expenditures of federal government for the year 2020-21 are estimated at Rs 6,344 billion which are 16.7 percent and 12.99 percent lower when compared to the revised estimation and actual estimation of current expenditures during outgoing year.

–Mark-up payments for the year 2020-21 have been estimated at Rs 2,946 billion out of which Rs 2,631 billion would be paid on domestic debt and Rs 315 billion on foreign debt.

–Expenditures of Rs 470 billion have been estimated for pensions which are 1.4 percent higher when compared to the revised estimates of Rs 463.4 billion for the outgoing year 2019-20.

–For Defence Affairs and Services, an amount of Rs 1,289 billion has been estimated for the year 2020-21 compared to revised estimation of Rs 1,227 billion for the outgoing fiscal year 2019-20.

–For grants and transfers, Rs 904 billion have been estimated against Revised estimation of Rs 1,177 billion for the year 2019-20.

–Subsidies have been estimated at Rs 209 billion against revised estimation of Rs 349.5 billion for 2019-20.

–For running of civil government, Rs 475.7 billion have been estimated for the fiscal year 2020-21 against revised expenditures of Rs 445.8 billion in 2019-20.

Analysis

The federal budget for the fiscal year 2020-2021 comes at a challenging time when economic growth all over the world has been severely impacted by the coronavirus pandemic. It appears that the government has attempted to create a favourable budget in order to provide some sort of relief to the common people and decided against burdening them with a new set of taxes. This, the government hopes, would contribute in reviving economic activity that has stagnated during the last few months.

That the government did not announce an increase in salaries and pensions of its employees and pensioners clearly shows that it has had to make difficult decisions due to the many constraints presented by the ongoing economic situation in the country and worldwide. This is also why subsidies have been slashed by 40 percent. The focus seems to be on inviting foreign direct investment (FDI) targeting a 25 percent increase and using public investment to create jobs and address poverty. The government is also hoping that it will be able to spend its development budget on areas previously ignored and help remove the vast disparities that exist in different parts of the country. The increase in the budget for defence is expected because of an increasingly aggressive India and the need to improve border management. Perhaps the most unfortunate aspect of this year’s budget is that the biggest chunk, Rs2.946 trillion, has had to be allocated for interest payments and debt servicing. To manage everything else with what is left behind is rather difficult.

Perhaps the government could have introduced a greater increase in the health budget as the healthcare system is under tremendous pressure. Education should have been prioritised better as well. This year, the government has placed immense trust in the FBR’s ability to perform, as the body is expected to achieve a Rs4.963 tax collection target, which would be a significant increase from the preceding year. Let’s hope it can rise to the occasion.

An Analysis of Provincial Budgets

Punjab and Sindh

Punjab and Sindh presented their budgets this week. Punjab’s total outlay was Rs2.24 trillion, backed by a 13% improvement in provincial tax collection. The province is also providing a Rs56 billion tax relief to businesses to help cope with Covid-19. Tax rates on over 20 services would be cut from the present 16% to just 5%. These include smaller hotels, wedding halls, catering, IT services, tour operators, gyms, property dealers, and car rental services. Sales tax on health insurance, doctor’s fees and hospital fees are also being slashed. In an interesting effort to digitise the economy, the Punjab government is proposing maintaining the 16% sales tax on restaurants and beauty parlours for cash payments, but cutting it to 5% for electronic payments. The development budget has been set at Rs337 billion, and sales tax for public-private partnerships has been cut to zero for five years to attract investment. The education budget is Rs391 billion, and the health budget is Rs284 billion, which includes Rs13 billion for Covid-19 pandemic response.

The Sindh government, meanwhile, prioritised the health sector in its Rs1.24 trillion deficit budget. No new taxes have been added, and government salaries have risen by up to 10%. Some 1,414 new government employees will also be hired. The development budget has been set at Rs232.9 billion, down 18% from last year. The increase in non-development spending was attributed to ‘Covid-related pro-poor’ social protection and economic sustainability spending of Rs34.2 billion, a Rs19 billion rise in health spending, and an additional Rs22.9 billion for education. One of the other positives was a Health Risk Allowance equal to one month’s basic pay for all health personnel, including postgraduate and house job officers, who have been working on Covid-19 patients.

While both budgets for the country’s two richest provinces have their strengths and weaknesses, it is clear that one focuses on economic recovery from Covid-19, and the other on saving lives.

KP and Balochistan

Khyber-Pakhtunkhwa and Balochistan have both announced their budgets, and as expected, there has been significant belt-tightening brought on by the economic impact of Covid -19 and other revenue issues.

In K-P, the development budget declined by 0.3% from last year to Rs318 billion. However, that does not account for the fact that, due to the cash crunch, actual spending this year was Rs98.5billion less than budgeted. Interestingly, almost Rs86 billion of the development allocation for next year is foreign-funded. Of the total, around Rs39 billion in development funding is for education, including Rs30.2 billion for elementary and secondary schools. This is a credible investment in tough times — 300 new schools will be built, and 1,700-plus will see upgradation or uplift work. There is also work under way to improve the monitoring of schools with around 3,000 assistant-sub divisional education officers to be recruited to supervise government schools. Currently, one ASDEO monitors about 60 schools, which the government hopes to bring down to a more realistic eight-to-one ratio. Another Rs24 billion has been marked for health in the development budget, apart from a Rs18 billion allocation for water.

Balochistan, meanwhile, unveiled a Rs465.528 billion budget, with a deficit of Rs87 billion. Despite all of the factors, that 18% budget deficit is eye-catching. Realistically, it is hard to believe that at this time next year, the government will have gone ahead with such a large deficit. Remember, the federal government has already cut Balochistan’s allocation by around 10%, and this figure could well rise. Also, we worry that the eventual subjects of cuts would likely be the usual suspects — health and education. The provincial education budget is Rs64 billion, while health has gotten Rs38 billion. Only Rs118 billion will be spent on development expenditure, another figure where actual spending will likely be curtailed as the year progresses. Around Rs8 billion has been earmarked for coronavirus and other disaster response, and another Rs3 billion for the post-coronavirus relief programme.

While both provinces have put out ambitious budgets with well-intentioned investments in critical sectors, K-P’s seems to be more realistic, given the expectations of budget cuts.

AJK

Azad Jammu and Kashmir (AJK) budget for the fiscal year 2020-21 has a development outlay of Rs. 24.5 billion, same of the current fiscal year showing the total volume of Rs. 139.5 billion without any deficit. The total income for the fiscal year 2020/21 has been estimated Rs. 115 billion compared to the current fiscal years estimate of Rs. 97 billion which shrunk to Rs. 94 billion in the revised estimates of current fiscal year presented in the house.

The current expenditures for the coming fiscal year are estimated Rs. 115 billion same as estimates of income and the development expenditures of Rs. 24.5 would be provided from federal government in the form of grants.

The government itself would collect Rs. 28.5 billion out of which Rs.20.6 billion in the head of income tax and Rs. 7.9 billion in the head of other taxes and share from FBR taxes is estimated Rs. 70 billion, Rs. 19.9 billion are estimated from the state revenue and Rs. 670 million in the head of use charges from the federal government.

In the head of current expenditure, a huge amount of Rs. 28.88 billion has been allocated for education department; Rs. 22 billion has been allocated for the payment of pension to retired employees, Rs. 10 billion has been allocated for health department, an amount of Rs. 16.524 billion has been allocated in the head of miscellaneous expenditures (grants) while Rs. 8.762 billion has been allocated for electricity department.

In the development expenditures, the biggest amount of Rs. 10.2 billion has been allocated for roads and communication network, more than Rs.2.57 for education, Rs. 2.795 for local government and rural development, Rs. 2.155 billion for housing and physical planning, Rs. 1.7 billion for power development and one billion rupees for development schemes of health department.

Jahangir's World Times First Comprehensive Magazine for students/teachers of competitive exams and general readers as well.

Jahangir's World Times First Comprehensive Magazine for students/teachers of competitive exams and general readers as well.