Economic Survey of Pakistan 2019-20

No hits, many misses!

On June 11, Adviser to Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh launched Economic Survey of Pakistan 2019-20, according to which the country missed all major economic targets due to the coronavirus outbreak, which resulted in a negative 0.4 percent economic growth rate for the outgoing year. This negative growth happened mainly as a result of dismal performance of industrial and services sectors. However, agriculture and small industries both largely in the informal sector posted positive growth. The only mentionable achievement the Survey reported this year is reduction in the current account balance by 71 percent.

The Economic Survey of Pakistan 2019-20 is out now, and according to this annual document, growth targets in the sectors of agriculture, livestock, industry, minerals, services and finance could not be achieved, due to coronavirus. The Survey shows that the economy’s resilience in a deepening crisis has been impaired as it has shown worst performance in 68 years. The Survey has given a preliminary estimate of the GDP growth rate this year which is 0.4 percent. The last time the GDP declined in a particular year was as far back as 1951-52, when the economy was hit by a big decline in agricultural production. This time it is clearly the large negative impact of Covid-19. However, amidst the overall dismal performance of industrial and services sectors, agriculture and small industries both largely in the informal sector posted positive growth. While agriculture has largely been immune from the effects of coronavirus, the document paints a bleaker picture among other sectors. The document says, “72% of Pakistan’s non-agriculture workforce is engaged in the informal sector, with no social security or insurance cover and it may take a major hit. The estimated size of informal employment in non-agriculture sector is around 27 million, with only food, pharmaceuticals, and few services still functional, these employees will be worst affected.”

The data released by the government presents a dismal performance as all indictors painted broad-based setbacks. Although Adviser to the Prime Minister on Finance and Revenue, Dr Abdul Hafeez Shaikh, has blamed Covid-19 for the loss of over Rs3 trillion to the national income, the period covered by the data includes mostly the first nine months of the fiscal year (July 2019 to March 2020), much of what is portrayed cannot be attributed to the disruptions from the pandemic.

Addressing the launching ceremony of the Survey, the advisor said that the fiscal year 2020, before coronavirus spread, showed dedicated efforts of the government for addressing structural issues that had caused macroeconomic imbalances back in FY 2018. However, numbers show a startling picture. For example, credit to the private sector fell sharply from Rs554.7bn last year to Rs187.3bn this year in the July to March period. This is a marked decline and shows a sharp deceleration underway in private sector activity. The breakdown paints an even starker picture. Working capital loans, for example, dropped from Rs369bn last year to Rs28.8bn this year in the same period. Loans for fixed investment dropped from Rs83.1bn last year to negative Rs5.2bn this year, meaning on net there was negative investment in the country this fiscal year. At the same time, the amount of foregone revenue from tax exemptions jumped to Rs1.15tr this year. Only a few years ago, the figure was less than half this amount. The sharp increase in exemptions given to businesses over the two years that this government has been power has no doubt contributed to this picture.

Stabilisation continued to be defined by the economic team leaders, echoed in the Survey, as a decline in the current account deficit, which began declining from December 2019, well before the new economic team was installed—from 20 billion dollars inherited by the PTI administration to around 11.4 billion dollars by April 2019 – a decline of 43 percent. By March 2020 (pre-Covid-19) the current account deficit had declined to 2.8 billion dollars or a decline of 75 percent from April 2019 and this is partly attributable to the massive decline in the international oil prices, a major import item for the country, higher remittances which are expected to decline post-Covid-19 due to lockdown in the Middle East and other countries while exports rose by a couple of hundred million dollars.

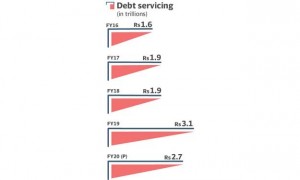

However, an incredibly high price was paid for this narrowing in the current account deficit from May 2019 to April 2020 through contractionary fiscal and monetary policies including: (i) an unrealistic tax target of 5.5 trillion rupees that was to be realised through widening the tax net but with sustained opposition by powerful pressure groups the government failed to achieve the target. However, it raised total revenue by 30.9 percent in comparison to the previous year by increasing taxes, particularly minimum tax based on turnover, on existing taxpayers, thereby stifling the economy. Expenditure, however, could not be reined in; it registered a 30 percent increase in current and 40 percent in development expenditure; (ii) market-based exchange rate from the second week of May 2019 that led to a large rupee depreciation resulting in a massive rise in the country’s debt payments as each rupee loss of value against the dollar adds around 100 billion rupees to the country’s debt. For the first time, perhaps, the primary balance was stated to be a positive 0.5 percent during the first nine months of the current year but for some reason, this statistic is not reflected in IMF’s Rapid Financing Instrument documents for the entire year for either pre-Covid-19 (negative 0.8 percent) or post-Covid-19 (negative 2.9 percent) projections; and (iii) a high discount rate that stifled all economic activity leading to a decline in private sector borrowing.

Thus if stabilisation implies negative industrial growth (2.64 percent with a decline of negative 7.78 percent in large-scale manufacturing sector), rising unemployment pre-Covid-19 not quantified (with PIDE study quoted in the Survey focused on post-Covid-19 period maintains that 1.4 million jobs would be lost in case of limited pandemic-related restrictions and 12.3 million in case of a complete shutdown), a decline of 0.59 percent in the services sector with 3.43 percent decline in wholesale and retail trade and 7.13 percent in transport, storage and communications, the unchecked locust attack coupled with serious water issues has not only badly affected the output of a sector that to all purposes was immune to the attack of the pandemic (agriculture sector target grew by 2.67 percent against the target growth of 3.5 percent) but has pushed millions of farm workers and small and subsistence farmers under the poverty line and a rise in inflation from its pre-May 2019 level then stabilisation was achieved. Covid-19 exacerbated the issues facing the economy that began soon after the economic team leaders agreed to the IMF’s prior conditions on 12 May 2019.

Growth projection of negative 0.38 percent for the current year in the survey is markedly lower that that made by the IMF of negative 1.5 percent (April 2020 documents on the Rapid Financing Instrument) and the World Bank’s negative 2.6 percent (May documents on Global Economic Prospects). The Advisor’s explanation: the divergence is because of uncertainty generated from different values placed on the duration, extent and restrictions imposed to tackle the spread of the virus. Be that as it may, erring on the side of misplaced optimism appears not to be a wise approach as that may blindside the government from taking timely appropriate mitigating measures in the budget particularly when the virus is yet to peak in Pakistan.

Growth is a critical projection on which key macroeconomic indicators, for example, tax-to-GDP ratio, development and current expenditure as a percentage of GDP, public debt as a percentage of GDP and fiscal imbalance as a percentage of GDP are calculated. It is hoped that the negative 0.38 percent growth rate projected for 2019-20 in the Survey would not be a component of the budget to be presented to parliament today, especially if last year’s budget projections that mirror what was indicated in IMF’s EFF documents are taken as precedence. And in the event the budget is based on the Survey growth rate, then the budget is likely to be of a lesser duration than previous ones whose validity lasted no more than a quarter of a year, necessitating ‘mini-budgets’ that included readjustment in expenditure and revenue generation.

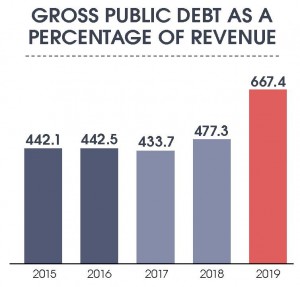

This is not to underestimate the impact of Covid-19 on the country’s fragile economy but we must not lose sight of the fact that things were not hunky-dory before the onset of Covid-19 either. The current year will end with a fiscal deficit of 9.1%. The total public debt from July 2019 to March 2020 soared to 88%, up from 74.2% of the GDP from the corresponding period of last year. And if liabilities are added, the ratio jumps to 102.6% of GDP. Empirical evidence shows that most of the countries which have succeeded in balancing the government’s books and achieving durable stability have focused on rightsizing the government. Tax exemptions have surged to Rs1.15tr this year. Critics recall that it was half the amount a few years ago. The circular debt in the energy sector and huge losses of bleeding state-owned enterprises are far from being resolved.

The government did succeed in curtailing imports during July-April by 16.2% but exports were on a downward trajectory, falling 3.9% during the same period as compared to last year’s comparative figure. However current account was reduced by 71%. The exchange rate remained relatively stable after the rapid depreciation of the rupee. Foreign exchange reserves were replenished through external capital and financial inflows and dollars remitted by overseas workers.

As the current trends observed in the economic survey indicates both high growth and durable stability may remain elusive in the immediate future. The situation calls for a culture change in the country’s economic management.

Highlights of the Survey

Following are the highlights of Economic Survey of Pakistan 2019-20:

- Provisional GDP growth estimated negative 0.38%

- Agriculture sector grew by 2.67%

- Cotton production reduced 6.9%

- wheat production grew by 2.5%

- Rice production increased by 2.9%

- Sugarcane production reduced by 0.4%

- Industrial sector grew by 2.64%

- LSM sector growth decreased by 5.4%

- Fertilizers production grew by 5.81%

- Leather products increased 4.96%

- Rubber products increased by 4.31%

- Auto mobile production decreased by 36.50%

- Wood products decreased by 22.11%

- Coke and petroleum products decreased by 17.46%

- Mining and quarry sector decreased by 8.82%

- Fiscal deficit increased to 9.1%

- Total Expenditures increased by 15.8%

- Total revenues increased by 30.9%

- Current expenditure increased by 16.9%

- Development expenditure increased by 14.2%

- Non-Tax revenues increased 159.9%

- Direct tax collection increased by 14.1%

- Provisional government revenues increased by 12.2%

- SBP reduced policy rate by cumulative 525 bps

- NFA of banking sector increased by Rs 893.7 billion

- NDA of banking registered expansion of Rs587.6 billion

- Net govt borrowing increased Rs911.7 billion

- Govt borrowing for budgetary support increased by Rs1023.9 billion

- KSE-100 index registered modest growth of 0.61%

- Headlines inflation (CPI) averaged at 10.9% during Jul-May

- Urban food inflation recorded at 13.6%

- Rural food inflation recorded at 16.0%

- Whole Sale Price Index recorded increased by 11.1%

- Sensitive Price Index recorded an increase of 14.0 %

- Exports decreased by 3.9% in Jul-April

- Imports reduced by 16.2% in Jul-April

- Trade deficit contracted by 29.5%

- Remittances increased by 5.5%

- Net FDI increased by 126.8%

- Foreign exchange reserves till end April 2020 stood at $18.7 billion

- Average exchange rate remained Rs157.1 to a Dollar

- Eduction enrollment increased by 7.1%

- Number of teachers increased to 1.83 million

- Estimated population growth and fertility rate is 1.94 per annum and 3.3 children per women

- Rs456 million disbursed under Kamyab Jawan Scheme

Jahangir's World Times First Comprehensive Magazine for students/teachers of competitive exams and general readers as well.

Jahangir's World Times First Comprehensive Magazine for students/teachers of competitive exams and general readers as well.