Pakistan FATF

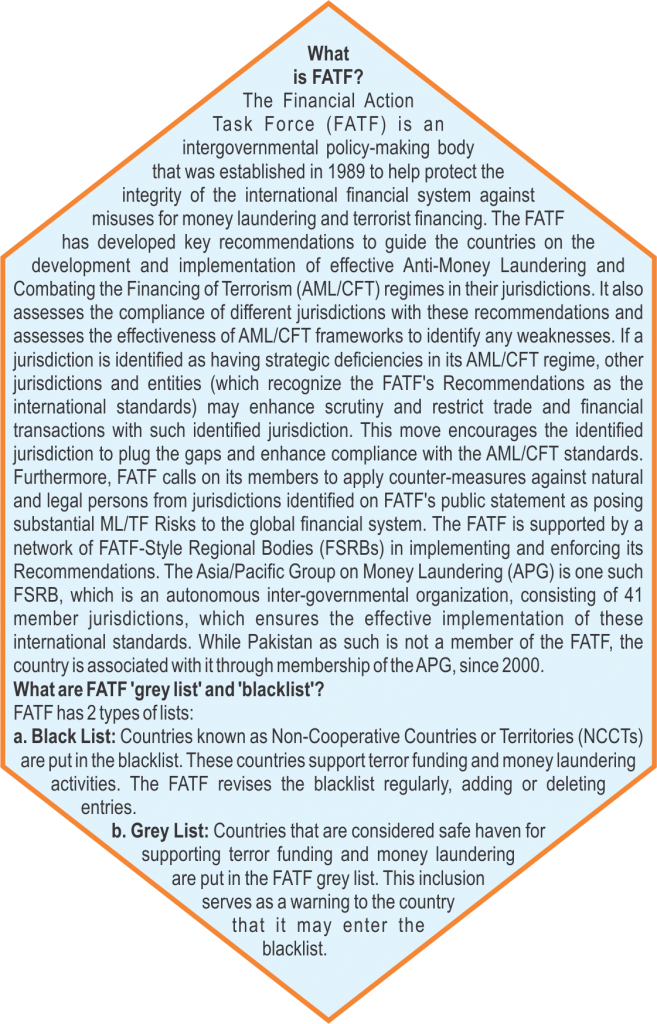

The recently concluded Financial Action Task Force (FATF) meeting in Paris has decided to keep Pakistan on its Grey List, demanding compliance again on three of the remaining 27-point action plan that was given to the country in June 2018. The decision came after a three-day virtual meeting of the FATF that began on February 22, during which steps taken by Pakistan against money laundering and terror financing were reviewed. “Three out of 27 [points] need to be fully addressed,” he said, referring to the action plan agreed to by Pakistan. While reiterating that Pakistan has made “progress”, the FATF president said: “[We] strongly urge completion of the plan [by Pakistan].” He said Pakistan “must improve their investigations and prosecutions of all groups and entities financing terrorists and their associates and show [that] penalties by courts are effective. As soon as Pakistan shows it has completed these items, FATF will verify and members of FATF will vote.”

As Pakistan has complied with 24 out of the 27 actions suggested by the FATF, it has finally boiled down to just three areas: (1) TF [terror financing] investigations and prosecutions of target persons and entities (2) TF prosecutions result in effective, proportionate and dissuasive sanctions, and (3) effective implementation of targeted financial sanctions TFS [terror financing sanctions) against all 1267 and 1373 designated terrorists, specifically those acting for or on their behalf.

The FATF announcement that Pakistan has made “significant progress” even if some “serious deficiencies” remain in the mechanisms to eliminate terror financing, and the government’s view that the country would not be put on the blacklist again, has been a ray of hope for all concerned. Reaching a compliance level of 24 targets out of the 27-point action plan is no mean achievement despite missing several deadlines. It entailed a whole lot of reorganisation of the legal, security, financial, trading, religious, regulatory and law-enforcement structures. This is especially significant because, until the recent past, pushed by various global adversaries, Pakistan’s system against money laundering (ML) and terror financing (TF) was found wanting. The deficiencies were so “strategic” in the areas of financial sector, border control, legal standards, investigations and prosecutions that even friends stood neutralised when it came to international arm-twisting on political considerations.

FATF Action Plan

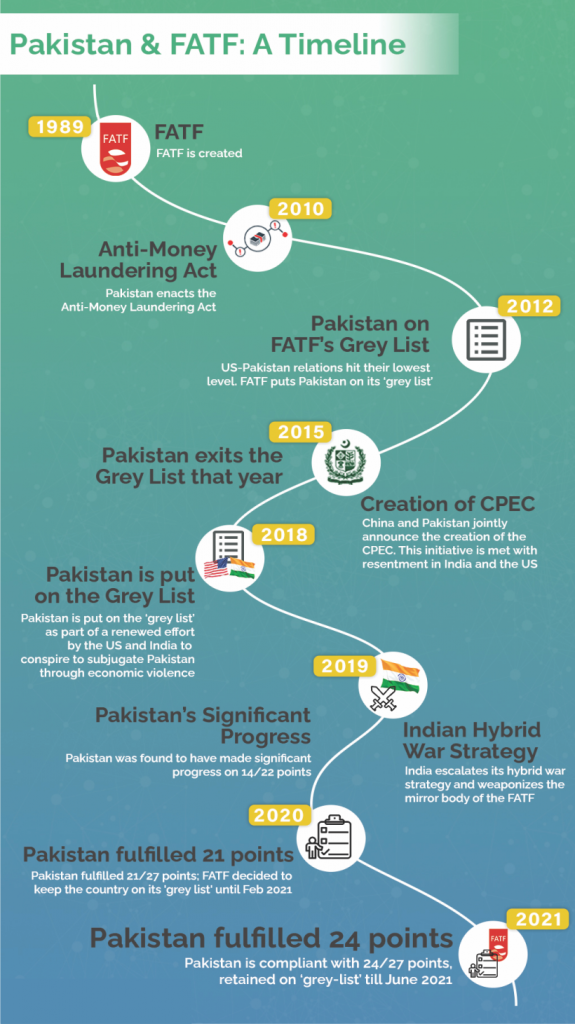

Pakistan was put on FATF grey list in June 2018 and was asked to implement the FATF Action Plan fully by September 2019. The grey-listing came as a jolt and woke up the authorities from deep slumber. So, the country made a top-level political commitment on a 27-point action plan. Roughly 10 items on the 27-point action plan pertain to the strengthening of the financial sector’s security, regulator protocols and border controls. Nine points belong to targeted financial sanctions against proscribed organisations and about eight cover robust investigation and prosecution mechanisms and systems. At least three dozen laws at the federal level had to be changed to meet the highest global standards along with upstream and downstream reporting networks. Pakistan was cautioned that non-performance could lead to being described as high-risk jurisdiction, subject to a call for action, commonly called blacklist, with lethal consequences like international financial exclusion.

Pakistan was put on FATF grey list in June 2018 and was asked to implement the FATF Action Plan fully by September 2019. The grey-listing came as a jolt and woke up the authorities from deep slumber. So, the country made a top-level political commitment on a 27-point action plan. Roughly 10 items on the 27-point action plan pertain to the strengthening of the financial sector’s security, regulator protocols and border controls. Nine points belong to targeted financial sanctions against proscribed organisations and about eight cover robust investigation and prosecution mechanisms and systems. At least three dozen laws at the federal level had to be changed to meet the highest global standards along with upstream and downstream reporting networks. Pakistan was cautioned that non-performance could lead to being described as high-risk jurisdiction, subject to a call for action, commonly called blacklist, with lethal consequences like international financial exclusion.

Over the past three years, the Government of Pakistan has taken serious steps to fulfil the commitments it made to the FATF. It amended or made almost three dozen laws during the past year to meet the FATF requirements. All these changes and new laws were essential to bringing Pakistan out of the FATF’s grey list in order to dispel the negative impression about the country’s ‘soft stance’ towards certain militant groups. These efforts have been acknowledged by the FATF. “To date, Pakistan has made progress across all action plan items and has now largely addressed 24 of the 27 action items. As all action plan deadlines have expired, FATF strongly urges Pakistan to swiftly complete its full action plan before June 2021,” the Paris-based financial watchdog said on the conclusion of its plenary and working group meetings. But, in spite of acknowledging Pakistan’s “significant progress” on the recommended actions, the decision to keep Pakistan on the grey list until June this year, has disappointed many because Pakistan has already faced huge economic losses due to this imbroglio.

Implications for Pakistan

Remaining on the grey list had serious financial consequences for Pakistan. An Islamabad-based think-tank has recently come up with a research paper which suggested that the country has sustained a staggering $38 billion economic loss due to the FATF’s decision to thrice place the country on its grey list since 2008. A large portion of $38 billion losses can be attributed to the reduction in household and government consumption expenditures, it added.

The losses are worked out on the basis of reduction in consumption expenditures, exports and foreign direct investment (FDI). The author, Dr Naafey Sardar, has argued that Pakistan’s removal from the grey list has, at times, led to the revival of the economy, as evident from an increase in the level of GDP for the years 2017 and 2018.

While an accurate economic analysis on this basis will be difficult and might well be hypothetical. Politically and diplomatically, Pakistan has had to endure a big loss. A continued listing in the FATF discourages better diplomatic relations with most countries. Also, potential investors and financial institutions will find it uncomfortable to do business with such a country.

Being on the FATF list means the country will face enhanced monitoring procedures. While there are no direct economic consequences but the listing impacts the country’s ability to attract foreign investment as well as the country’s imports, exports, remittances and access to international lenders.

Way Forward

The progress made by Pakistani authorities so far is remarkable. No country in the past had made such progress in a similar time span. In this backdrop, ‘largely compliant’ status on 24 items is laudable. In the next plenary scheduled for June 2021, if the work in progress on the three specified agenda items reaches satisfactory levels, then the on-site inspection (audit) will take place and based on satisfaction of its criteria, Pakistan can potentially come out of the grey list by October 2021. However, there is another process going on in parallel; Pakistan is also part of an FATF-style regional body – Asia-Pacific Group (APG) on money laundering.

APG has made a set of recommendations and intended outcomes. There are forty recommendations on which technical compliance will be judged. And assessment is based on 11 intended outcomes on which effectiveness will be judged. Based on the APG’s first follow-up report released in September 2020 – in continuation of MER shared in October 2019 – Pakistan had low effectiveness on 10 out of 11 intended outcomes. Based on the recommendations, 11 items were compliant or largely compliant, four were non- compliant, and rest were partially compliant.

The positive development is that the kind of work Pakistani authorities have done in the past eighteen months is remarkable. In the history of FATF, no country has worked on two action plans (second plan is of APG), simultaneously. Significant progress has been made on both plans. The fact of the matter is that over 14 laws have been enacted or amended. All requisite legislative work has been completed. Moreover, institutional level rules and regulations have also been made or revised by relevant bodies such as SBP, SECP, NACTA and FMU.

The authorities are confident that the FATF action plan and APG evaluation must remain separate. They believe that the work in progress on the remaining three items shall be completed by June 2021. For that to happen, strong diplomatic efforts are required as geopolitics also comes into play.

The authorities are confident that the FATF action plan and APG evaluation must remain separate. They believe that the work in progress on the remaining three items shall be completed by June 2021. For that to happen, strong diplomatic efforts are required as geopolitics also comes into play.

The merger of FATF action plan and APG evaluation will not happen. The FATF action plan shall meet closure independently. The progress on APG’s plan is good as the revisions in several legislations and regulations are part of APG’s recommendations. The work is taking place in parallel. The outcome is hinged on the report that shall be submitted by May 2021. In any case, the blacklist is out of the question as of now, which is itself a big sigh of relief.

Conclusion

Pakistan has completed almost 90 percent of its current FATF action plan with 24 out of 27 items rated as ‘largely addressed’ and the remaining 3 items ‘partially addressed’. Pakistan’s high-level political commitment since 2018 that led to significant progress has also been acknowledged by the global illicit financing watchdog. Pakistan’s target now is to complete the 27-point action plan to improve its economic indicators and send a clear message to the world that Pakistan’s financial system is secure.

The resilience and consciousness of authorities regarding the matter indicate that Pakistan will soon be able to free itself from the shackles of the grey list. However, it should not be underscored that even after Pakistan completes implementation on the whole action, the FATF will verify if the measures are sustainable for long-term. This means that Pakistan will need to ensure accountability and transparency by strengthening the concerned laws, systems and institutions while, at the same time, resolving previous pending issues related to terror financing. Bold moves will need to be made in order to prove Pakistan’s sustainable commitment.

The writer is a PhD Scholar (English Literature).

He can be reached at: hbz77@yahoo.com

Jahangir's World Times First Comprehensive Magazine for students/teachers of competitive exams and general readers as well.

Jahangir's World Times First Comprehensive Magazine for students/teachers of competitive exams and general readers as well.